News Release from windfair.net

Wind Industry Profile of

Courage Pays Off

When it comes to investments in renewable energies, Iberdrola from Spain and Enel from Italy are at the forefront. For several years now, they have been driving the energy transition and promoting the expansion of renewables. NextEra Energy in the U.S. and Danish offshore specialist Ørsted have also been committed to the energy transition early on.

In recent years, the number of companies wanting to get involved in the renewables business has grown steadily, because the battle for 'big oil' has long since turned into a battle for 'big energy'. The offshore wind sector in particular has become the playground of the big corporations, simply because this is where the most money is needed to get projects off the ground. Moreover, there is still great growth potential in the market, because countries like the U.S. or Japan are still at the very beginning of their development. Only in Europe and parts of Asia the industry has been established for a while.

Moreover, the overlap with the oil majors' experience in managing and developing the operations of large offshore oil and gas fields is obvious, as Forbes points out. The majors can use the synergies of their supply chains from oil and gas operations and existing project management experience to gain a foothold in the offshore industry. Norwegian group Equinor, e.g., has been betting on offshore and now floating wind for several years, and Shell from the Netherlands and bp from the UK have also recently invested large sums in offshore wind farms. To do this, some corporations first had to make a radical change of direction - often driven by their own shareholders, for whom investments in sustainable technologies are playing an increasingly important role.

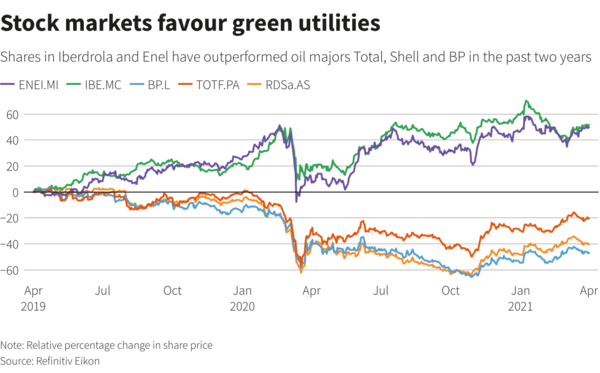

The shares of Iberdrola and Enel are well positioned compared to the traditional oil multinationals (Image: Reuters)

Enel and Iberdrola, on the other hand, have seen the energy transition coming decades ago, when others were still shying away from the then high costs of generating energy from sun and wind. “The energy transition has been part of my life,” Enel Chief Executive Francesco Starace told Reuters. “There was no eureka moment for us. We just said this is too stupid to be continued for a long time.”

And the move is paying off, with the switch sending their profits and share prices soaring in the past two years alone as investors turned away from oil stocks to invest in companies driving the energy transition.

In contrast, the oil multinationals are having a hard time, because Iberdrola and Enel have another decisive advantage: the flourishing business with electricity grids. Almost half of the two groups' revenues come from millions of kilometres of power lines owned by the two utilities. “Grids are the backbone of the energy transition,” Javier Suarez, head of utility desk at Milan’s Mediobanca, told Reuters. “Owning them means steady cash flow and lower investment risk.”

“Any new entrant into the industry is not going to be able to get access easily or certainly not cheaply to the really good legacy assets that Iberdrola and Enel have - the infrastructure assets,” Wood Mackenzie analyst Tom Heggarty stated.

And Pierre Bourderye of PJT Partners sums it up perfectly: “I don’t think it was simple to decide to spend money in renewables. If it had been simple others would have done it at the same time, but they did it 10 years later.” Courage just pays off.

- Author:

- Katrin Radtke

- Email:

- press@windfair.net

- Keywords:

- Iberdrola, Enel, Reuters, Forbes, Shell, Equinor, offshore, investment, shareholder, country, industry, oil, gas, floating, bp