News Release from windfair.net

Wind Industry Profile of

Power Purchase Agreements Increasingly Dominate Market Activity

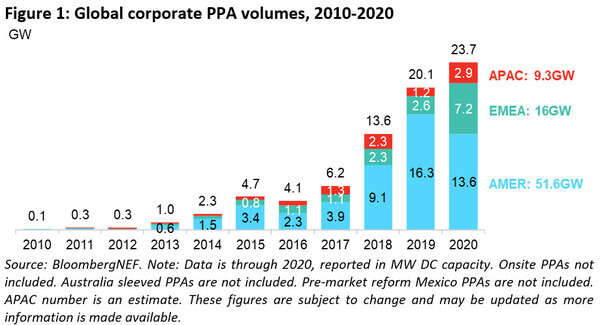

Last year, an increase of 18 per cent was recorded in the PPA market segment, as BloombergNEF shows in its annual data analysis. Although Corona plunged the global economy into crisis, which also affected the power sector, contracts totalling 23.7 GW were signed.

More than 130 companies have signed clean energy contracts, including an increasing number from the oil and gas sector, in addition to the big tech companies that are pioneers in this field. In addition, the market is supported by growing interest from stakeholders who are placing increasing emphasis on sustainability and access to clean energy in their investments, as described in BNEF's 'Corporate Market Outlook'.

Although momentum in the U.S. market slowed overall, Amazon was among the leading buyers of clean energy last year, signing a total of 35 separate PPAs. The volume of these contracts amounts to 5.1 GW. The American shopping giant has purchased over 7.5 GW of clean energy to date, putting it ahead of Google (6.6 GW) and Facebook (5.9 GW) for the first time, whose data centres in particular are gigantic power guzzlers, as Quartz notes.

Amazon's business model, on the other hand, is particularly problematic, as the activities associated with its purchases emit very large amounts of carbon dioxide each year. In 2019, the company disclosed its carbon footprint for the first time after employees pressured Amazon to do more to combat climate change, as AP reports. For 2019 alone, this amounted to 51.17 million tonnes, the equivalent of running 13 coal-fired power plants for a year. In 2020, the environmental footprint is likely to have increased again due to COVID-19 and the massive interest in internet shopping that has come with it.

However, Amazon has committed itself to being fully powered by renewable energy by 2030 - so the company will probably sign a few more PPAs in the coming years. Last year, the largest power purchase agreement in Europe to date was also on Amazon's account: An agreement was reached with Danish offshore wind farm developer Ørsted to purchase 250MW over ten years from the planned Borkum Riffgrund 3 offshore wind farm (900 MW) in the German North Sea.

The top 5 PPAs were completed last year by French oil company Total (3 GW), the Taiwanese semiconductor manufacturer TSMC (1.2 GW) and US telecommunications company Verizon (1 GW).

The volume of concluded PPAs is constantly increasing (Source: BloombergNEF)

As can be seen in the chart above, the market in the U.S. weakened but still remained on top. U.S. companies completed 11.9 GW, down from 14.1 GW in 2019, when both Asia-Pacific and Europe set annual records.

Asian PPA volumes doubled, with TSMC contributing. The company concluded a PPA with Ørsted in August for the power of a Taiwanese offshore wind farm. Taiwan established itself as a major clean energy market in 2020, with companies signing PPAs worth 1.25 GW. This momentum is unlikely to slow in the future, as Taiwan's market is set to be supported by a new directive requiring companies with an annual load of more than 5MW to buy clean power. And with the island having a high concentration of large manufacturers, many of whom are feeling pressure from their customers to decarbonise, there will continue to be a big focus on power marketing in the coming years.

- Author:

- Katrin Radtke

- Email:

- press@windfair.net

- Keywords:

- PPA, electricity, clean, energy, power, market, power purchase agreement, onshore, offshore, wind farm, solar, BloombergNEF, Taiwan, Asia, USA