News Release from windfair.net

Wind Industry Profile of

Light and Shadow in Offshore Wind Energy

Despite COVID-19 restrictions, a record €26.3 billion was invested in new offshore wind farms in Europe last year. This will finance 7.1 GW of new offshore wind turbines to be built in the coming years, as WindEurope reports.

“€26 billion in new investments in 2020 is a huge vote of confidence in offshore wind. Investors see that offshore wind is cheap, reliable, and resilient – and that Governments want more of it. And these investments will create jobs and growth. Every new offshore wind turbine generates €15m of economic activity. We expect the 77,000 people working in offshore wind today in Europe to be 200,000 by 2030”, says Giles Dickson, WindEurope CEO.

A new global record was also set for the commissioning of new offshore wind farms in 2020, as the World Forum Offshore Wind (WFO) reports in its 'Global Offshore Wind Report 2020': 5,206 MW were commissioned - hardly a significant increase compared to the 5,194 MW from 2019. While still a good figure in view of the pandemic, some developments in the industry are causing concern.

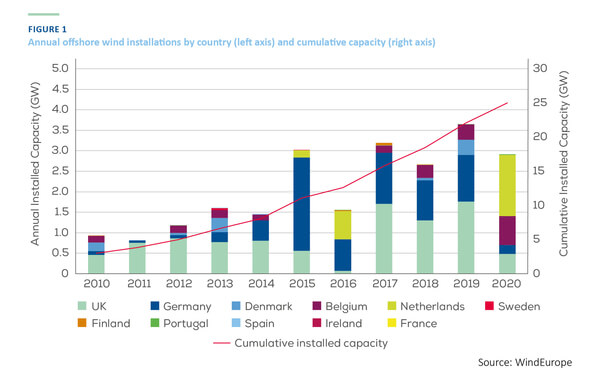

Addition of offshore wind energy in Europe (Image: WindEurope)

While a total of 2.9 GW of new offshore wind capacity was installed in Europe, core market Germany is weakening. The UK remains the largest offshore wind market in the world with 10.4 GW of total installed capacity, followed by Germany in second place with 7.7 GW. However, the approaching Chinese (currently: 7.1 GW) will have overtaken Germany in the coming statistics.

While the addition of 32 turbines with a capacity of 219 MW in Germany was already quite meagre, no new turbines could be built at all in the second half of 2020 due to wrong political framework conditions. And there's no commissioning of German offshore wind power planned for 2021 either. Meanwhile, 4,372 MW are currently under construction in China.

And this of all times, when the hydrogen market is also finally gaining momentum and is in urgent need of green power from the sea. "While the long-term framework conditions for the offshore wind industry have improved in the past year with the EU's Green Deal and the German government's new long-term targets until 2040, the short-term situation of the industry remains challenging with the very weak domestic market," German industry organisations comment on the weak expansion figures.

And Dickson also warns: "Let’s keep up this momentum! We now need a comprehensive legislative framework for hybrid offshore wind projects, improved maritime spatial planning and streamlined permitting procedures to unleash the full potential of Europe’s offshore wind!"

There are interested countries waiting in the wings though.

There are interested countries waiting in the wings though.

“Offshore wind is no longer just about the North Sea. It’s rapidly becoming a pan-European affair. More and more countries are making commitments on it. Poland, Spain, Greece, Ireland, the three Baltic States all have plans. And the rapid advance of floating offshore wind will help the build-out in the Atlantic, Mediterranean and Black Sea”, Dickson explains.

Construction activity on the oceans will also increase in other parts of the world. With Joe Biden as new U.S. president, experts now finally expect a breakthrough for offshore wind in the U.S. And only a few days ago, South Korea announced its intention to build the largest offshore wind complex in the world.

Technological innovations are also entering the market at the moment. The average turbine size installed last year was 8 MW. The size of turbines ordered already reached new records with the 13 MW GE Haliade-X (see left, Haliade in Rotterdam, image: GE Renewable Energy) and the 14 MW turbine by Siemens Gamesa. And they will continue to grow, as Vestas announced series production of its brand new 15 MW turbine for 2024 only yesterday.

- Author:

- Katrin Radtke

- Email:

- press@windfair.net

- Keywords:

- offshore, Europe, market, UK, Germany, wind farm, investment, China, manufacturer, turbine, installation, operation, construction