News Release from windfair.net

Wind Industry Profile of

Turbulences on the Turbine Market?

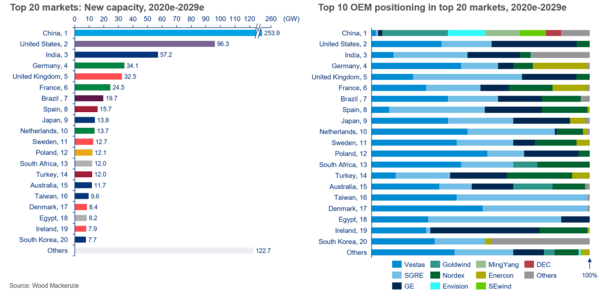

Actually the cards are clearly spread: Vestas, Siemens Gamesa and GE Renewable Energy have been dominating the turbine manufacturers' (OEMs) market for years. And that won't change in the future, quite the contrary. A new report by Wood Mackenzie even assumes that the three companies will be able to expand their joint share of the global market from the current 43 % (2019) to 60 % in 2029.

In recent years, however, it looked as if the three Western turbine manufacturers could face serious competition from China, as there have recently been more and more Chinese companies in the top 10 that have been successful, especially in the domestic market: "Ten of the top 15 turbine OEMs in 2020 will be Chinese, capitalising on a domestic demand surge," Wood Mackenzie said only last year.

However, the wind has now changed somewhat. In the middle of the corona pandemic, China recently announced that it wants to become climate neutral by 2060. This requires a huge effort on the part of the world's largest CO2 producer to date, plus support from abroad. This is because China also recently announced that it will withdraw from its feed-in tariff (FIT) at the end of next year. Thus the higher feed-in tariff for wind energy will be over then. Producers will have to face the open energy market.

How are the global wind energy markets developing? (Graphic: Wood Mackenzie)

What will happen before that is well known from other countries such as the U.S.: the announcement leads to a short-term construction boom. The increased demand will therefore also offer Western companies completely new opportunities. "China’s aim to meet the 2060 carbon-neutral goal may entice new entrants into the wind industry due to a significant increase in demand," says Shashi Barla, Wood Mackenzie Principal Analyst.

"Western turbine OEMs are expected to capture more than 10% of combined market share in China this year – the highest in the past decade – due to the Feed-in Tariff (FIT) termination. “FIT phase-out in China has triggered a near-term surge in the market, with tier II players climbing the 2020 rankings. Tier II Chinese domestics players are targeting the offshore market with 10+MW turbines, while the mainstream players look to 5-7MW technologies to strengthen their share,” explains Barla.

The two Chinese turbine manufacturers SEwind and MingYang are expected to dominate the domestic offshore market with a combined market share of 60 percent, despite increasing competition from other manufacturers.

The offshore sector in particular remains highly competitive worldwide. The great potential is far from being exhausted in many countries. Only recently, Vestas secured the share of its previous partner Mitsubishi in their offshore joint venture MHI Vestas Offshore Wind.

The global offshore wind market is booming (Image: Pixabay)

Nevertheless, Siemens Gamesa is likely to have the better cards in the long term and will be permanently at the top of the manufacturers' list by 2025 at the latest: "SGRE will secure the global number one ranking by 2025 and retain that position through the end of the decade," predicts Barla.

So is there still room for smaller manufacturers? Absolutely, if they continue to concentrate on their strengths. Especially smaller onshore markets off the beaten track offer opportunities. Thus after Enercon's financial difficulties, German manufacturer Nordex has been able to develop into a robust fourth competitor on global markets excluding China.

There are also opportunities in terms of green recovery after the corona pandemic if governments will continue to promote the expansion of renewable energies. There will be a lot of movement in the market in the coming years, Ben Backwell of the Global Wind Energy Council (GWEC) also recently predicted. At the beginning of the pandemic in spring, a slump in wind industry of around 20 per cent was expected, but the actual setback has been much smaller at only 6 per cent. According to Backwell, some governments have used the time to set new climate targets and ensure positive political decisions. And still much remains to be done.

- Author:

- Katrin Radtke

- Email:

- press@windfair.net

- Keywords:

- OEM, market, China, USA, Germany, Vestas, Siemens Gamesa, onshore, offshore, Nordex, Enercon, turbine manufacturer, opportunity