News Release from windfair.net

Wind Industry Profile of

Wind Turbine Manufacturers: Vestas Stays On Top

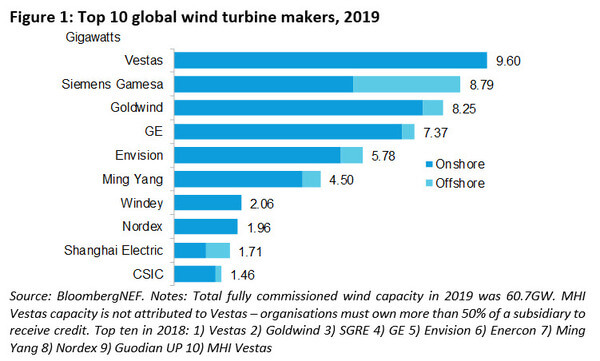

Last year, approximately 61 gigawatts of wind turbines were put into operation worldwide, as the annual statistics from BloombergNEF show. This is an increase of 22% over the previous year, when 50 GW were installed. A further increase to 75 GW is expected this year. 88% of the turbines were installed onshore, while the offshore share rose to 12%.

Four manufacturers alone are responsible for the lion's share of 55 percent: Vestas from Denmark, Siemens Gamesa (Germany/Spain), Goldwind from China and General Electric from the U.S. However, Vestas lost market shares and now only accounts for 18% (previous year: 22%). Meanwhile, Siemens Gamesa benefits from the fact that the company has a very broad base in both the onshore and offshore market. Thanks to a very good offshore year, SGRE was therefore able to jump from fourth to second place in the overall index.

The strong Chinese market means that a large proportion of the top 10 manufacturers now come from China, while the competition from Germany (Enercon, Senvion) and India (Suzlon, Inox) can no longer keep up with the world leaders. This is mainly due to the slump in the respective domestic markets, where these manufacturers have traditionally been strong. It is clear that the more prepared the companies are to act globally, the greater their market share.

Advantage for broad-based companies: Onshore and offshore installations are both included in this chart. (Image: BloombergNEF)

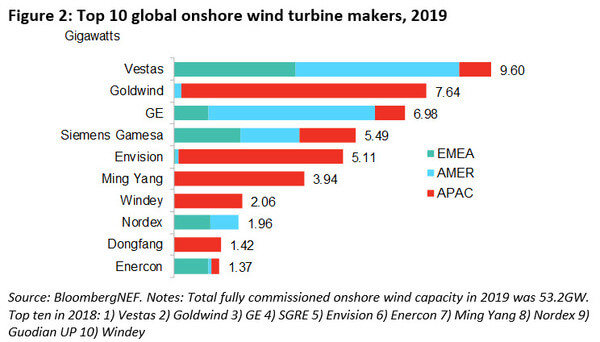

"Underpinning each of the leading onshore players is a strong presence in either the U.S. or China,” explains Oliver Metcalfe, wind analyst at BNEF and lead author of the report 2019 Global Wind Turbine Market Shares. “2020 is set to be another strong year for installations in China and the U.S., as developers rush to build before subsidies lapse, but uncertainty post-2020 could expose some bigger players unless they diversify to new growth markets."

Regarding the figures for onshore installations only, there are slight differences compared to the first chart. (Image: BloombergNEF)

Offshore, Siemens Gamesa continued to dominate the world market. Compared to 2018, the German-Spanish company was able to more than double the number of installed capacity: In the UK alone, almost two gigawatts were commissioned, including the 1.2GW Hornsea Project One.

Tom Harries, head of wind research at BNEF, said: “This bumper year for offshore wind is just the start. If you look past a likely blip in 2020, installations are set to accelerate, breaking the 10GW-a-year barrier in 2023. This growth outlook has led to intense competition between turbine makers. At the moment, the advantage lies with the manufacturer selling the most powerful turbine. Industrializing the production of a slightly smaller turbine through higher volumes could lower costs and prices. The opportunities for turbine makers to offset lower prices with long-term maintenance contracts is less clear than it is in onshore wind."

- Author:

- Windfair Staff

- Email:

- press@windfair.net

- Keywords:

- Vestas, Siemens Gamesa, GE Renewable Energy, wind turbine, turbine, manufacturer, USA, China, Europe, Germany, offshore, onshore, Top10, wind power, wind energy