Crash In Supply Chain May Threaten U.S. Wind Industry

A new study by Wood Mackenzie Power and Renewables found that increased demand for transportation capacity due to growth in partial repowering activity, logistics requirements, and competition from other industrial sectors could severely hamper the transportation segment’s ability to ship components.

Dan Shreve, head of global wind research at Wood Mackenzie Power & Renewables, said: “These supply chain constraints will escalate deployment risks for all wind energy participants – increasing the likelihood of higher costs, missed deadlines, lost production, and fewer PTCs if projects can’t be commissioned in time.”

According to the analysis, if these supply chain constraint issues are not addressed, more than 23% of the wind energy capacity installations expected in 2019-2020 could be delayed or cancelled.

Moreover, turbine installations could decline by 1.1GW capacity – 366MW in 2019, 720MW in 2020 – representing a loss of more than US$800 million in turbine sales. PTC impacts, while more complex to estimate, could represent lost revenue of up to US$1.3 billion over the 10-year tax credit period.

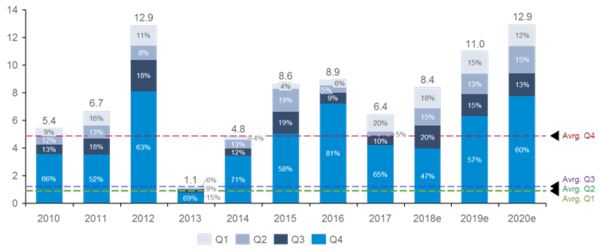

U.S. historical and forecast wind capacity installations (Forecast estimates reflect the Q2/2018 Market Outlook) Update (Image: Wood Mackenzie Power & Renewables)

“While we've seen upticks in demand put pressure on transportation capacity in the past, the total level of effort required from logistics providers this time around will be substantially higher than during past peaks,” Mr Shreve said. “New turbine technology is producing higher-capacity turbines, but this results in further strain on the supply chain, as components are larger and heavier, and more component shipments are needed per turbine. This in turn increases requirements for highway escorts, reduces transportation equipment cycle times, and increases demand for larger cranes.”

The report, commissioned by the Wind Energy Logistics Group – an organisation made up of participants from 16 key companies across the wind energy supply chain, including major equipment manufacturers, transport and logistics companies, and wind energy developers and installers – outlines the following collaborative actions that can help close the gap:

- Shift installation schedules and transport deliveries to minimise quarterly peaks;

- Establish forward storage sites to pre-position component inventories near wind farms;

- Prepare transload and wind farm sites to accept early deliveries;

- Prioritise shipments to the most efficient sites and wind farms;

- Communicate these findings and develop action plans now.

“Aggressive action by supply chain participants is needed now to solve this impending supply/demand gap and reduce or eliminate the demand shortfall and the $2.1 billion revenue at risk,” Mr Shreve said. ”A different mode of operation will be essential in 2019 and 2020, requiring an immediate and broad-based collaborative effort.” He added: ”The industry should also seek public policy relief to allow PTC extensions to 2021 and beyond, which would support the wind energy industry’s efforts.”

- Source:

- Wood Mackenzie Power & Renewables

- Author:

- Windfair Staff

- Keywords:

- Wood Mackenzie Power and Renewables, report, supply chain, crash, logistics, USA, wind energy, demand, turbines, components, PTC