News Release from windfair.net

Wind Industry Profile of

Calm before the Storm: Top 10 of Turbine Manufacturers Are Facing Major Upheaval

As the 2016 figures show, it is increasingly necessary in the field of turbine manufacturers to be set up as broad as possible in order to compete at the top. This includes not only the largest possible portfolio of specific turbines for various locations, but also the countries whose markets are served. And while some companies are able to stand on their own others continue to have joint ventures and mergers.

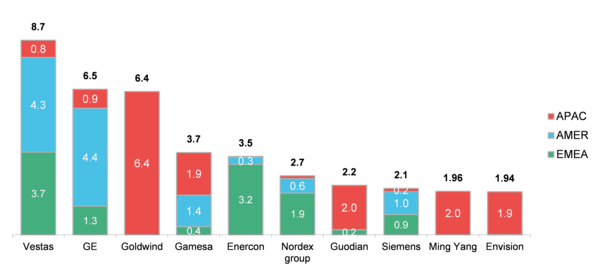

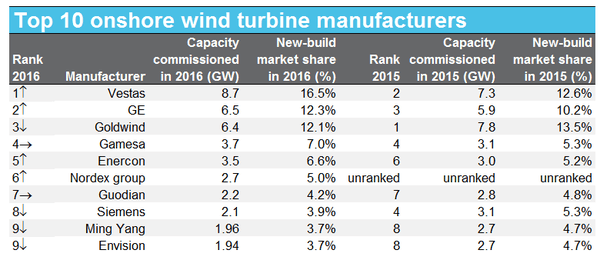

Virtually free of such thoughts are the Danes of Vestas. In 2015, the company fell – quite surprisingly – to second place behind Chinese Goldwind, but a further enlargement of their markets in 2016 led to a return to the top spot in onshore installations: 8.7 gigawatts of new turbines were built last year by Vestas. This corresponds to a good 16 percent of all worldwide onshore installations. For the first time the Danes succeeded even in pushing domestic supplier GE from the US top spot. Vestas is currently represented in 35 countries, including exotics such as Honduras or Jordan – no other manufacturer has a similar range.

Offshore, however, they do not reach the top position this year allthough their joint venture with Mitsubishi is very well positioned. They are building the world's most powerful offshore turbine at the moment. But yet this turbine has not been set up in commercial wind farms.

Includes onshore turbines only. Ranking based on BNEF project data base and selected market sources. (Source: Bloomberg New Energy Finance.)

Further expansion of the market has also helped GE to achieve a second place in the ranking, with 2015 being only 3rd. The Americans have also expanded in recent years, staging their market entry in seven new countries last year, bringing them up to 21 national markets. In addition, with the acquisition of Alstom and their Haliade turbine, they were just in time to equip the first American offshore wind farm Block Island.

Goldwind on the other hand fell back to third place last year. As they are almost exclusively active in their home market, it will be more difficult to keep up their position in the future, as the Chinese market has already started to spin last year. According to current plans by the Chinese government, the extremely high construction numbers of the past will not be repeated, even if a further expansion of renewable energies is targeted.

In the fourth place are the Spaniards of Gamesa, whose strength is not – as might be expected – in the Spanish-speaking countries, but mainly in India, where the company has been active intensively for many years. One third of Gamesa's new installations were made on the subcontinent last year.

German manufacturer Enercon still occupies the fifth position, but has installed nearly one half of their capacity in their domestic market. However, with a change of policy towards a tender system and a capping of onshore wind power in Germany, it will be more difficult for the company to hold this place in the coming years. Although experts expect a record increase in Germany due to full pipelines in 2017, this could change by 2018 at the latest. For example, Övermöhle Consult & Marketing GmbH predicts a market drop of 40 percent.

The two other German manufacturers have already reacted and have entered mergers: Nordex, who will be working with Spain’s Acciona in the future, is ranked 6th at the moment while Siemens even fell by four places to the 8th rank. However, the merger of the two (onshore) wind energy divisions of Siemens and Gamesa will ensure that – at least on paper – a new leader is emerging on the market.

“This years’ ranking shows why 2016 was all about mergers in the turbine-maker sector,” said David Hostert, head of wind research for BNEF. “There is now a strong group of three companies at the front, with a fairly tight field following. The upcoming merger of Siemens Wind and Gamesa will allow the joined company to catch up and create a ‘big four’ group of dominant manufacturers. Staying at the front of this pack will require both significant size and a balanced presence in the right markets.”

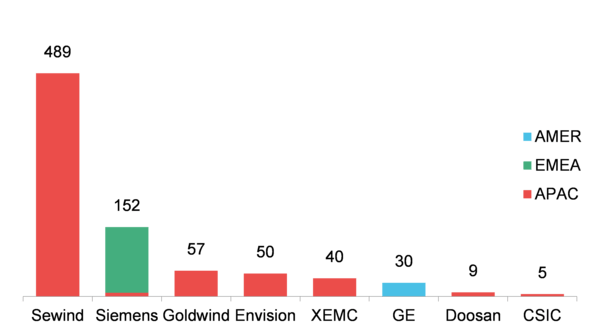

Includes offshore turbines only. (Source: Bloomberg New Energy Finance)

In addition to this, the traditionally strong offshore sector is also a part of Siemens: Sewind, a Chinese company, marks the front rank in offshore installations, but they use Siemens licenses produced exclusively in Asia. Second place goes to Siemens itself which supplies the rest of the offshore world.

The other places in on- and offshore ranking are dominated by Asians: China's Guodian United Power is ranked 7th ahead of Ming Yang and Envision, who are both tied to ninth place. In the offshore sector, Doosan, CSIC and XEMC are also added.

2017 is therefore likely to be a year of change, especially as in some markets it is not yet possible to predict how the situation will develop. The South American market, for example, has already cooled noticeably in 2016, as has the Chinese one. In the past year, the Americans ensured a consistently strong growth rate. It remains to be seen whether the election of wind power critic Donald Trump as US president will actually have direct influence on the situation in the US.

(Source: Bloomberg New Energy Finance)

- Author:

- Katrin Radtke

- Email:

- press@windfair.net

- Keywords:

- turbine manufacturer, top10, ranking