News Release from windfair.net

Wind Industry Profile of

Milestones and Consolidations: Turbine Manufacturers in 2016

While the global market leader, Chinese Goldwind, mostly supplied their domestic market relatively unobserved, the follow-up turbine manufacturers were fighting for market shares last year in the rest of the world. And while some companies were already busy planning their Christmas holidays, staff at the manufacturers worked on until the last minute.

Vestas has probably set the record. The current number 2 among manufacturers has been able to close orders with a capacity of more than 2 gigawatts in the last two weeks of the year. Their pipeline Includes orders of more than 1,5 GW from the US alone. This means that the turbine factory in Colorado will be well utilized in the coming years and will do exactly what US President-Elect Donald Trump demands: jobs and investments in the American market.

“By employing wind energy, the Wind XI project will bring clean, domestic, low-cost energy to MidAmerican customers as well as hundreds of millions of dollars in economic benefits to Iowa communities and long-term American jobs through the manufacturing, construction, and operations of Wind XI”, said Chris Brown, President of Vestas’ sales and service division in the United States and Canada.

However, Vestas is flexible in terms of delivery locations, as the Danes have been acting globally, just like no other manufacturer. In Brazil, last year, Vestas cracked its own 1.5 gigawatt mark, despite the fact that the otherwise quite excited South American market cooled down noticeably in 2016. In Brazil, an auction planned towards the end of the year was even postponed, which did not detract from the good numbers.

Orders from Honduras, Jordan and the Ukraine also helped to celebrate the annual financial statements at Vestas. Following the example of Costa Rica, which has been able to supply itself with almost 100 percent of renewable energies last year, other countries in Central America are now investing in wind power. For the first time ever, Honduras is building a wind farm.

Sky is the limit for Vestas (Image: Vestas)

Also Ukraine is a market with high potential. In the last few years, the conflict with Russia hindered the expansion of the wind market, but the Ukraine wants to back off from Russian oil and gas imports, in order to supply itself independently with energy. In Russia itself wind energy is hardly a topic for now, only German manufacturer FWT has so far attracted attention with its first projects in the area of the former Soviet Union.

In addition to their successful onshore turbines, Vestas can also continue to rely on its offshore business. In the joint venture with Mitsubishi, they currently supply one of the most powerful offshore turbines world-wide. Thus their 8.4MW turbine has recently been chosen to be installed in Belgium's largest offshore farm.

However, offshore market leader Siemens continues to be the one to beat. Once again, lucrative orders were booked, especially in Europe.

On the other hand, headlines were made by the merger with Gamesa. This is how the world's largest turbine empire has been created: Combining the Germans' and Spaniards' market shares will probably bring a change at the top 10 manufacturers next year. Above all, the Spanish-speaking market offers Siemens further investment opportunities in the near future.

German manufacturer Nordex is also in the forefront for Latin and South America, which is why the merger with Spanish Acciona Windpower was fixed last year. Towards the end of the year, this combination already paid off in Mexico and Argentina, and Latin and South America will also be a focus in the coming years, as the companies also own a production facility in Brazil.

In the middle of the year, another joint venture made headlines when a global bidding battle broke out around offshore producer Adwen. The company, which was owned half by Gamesa and Areva respectively, was at display, as Siemens initially showed no interest in the takeover of their offshore turbines. This, in turn, brought American conglomerate General Electric and German turbine manufacturer Senvion to the scene. Ultimately, however, Siemens decided to take over the shares themselves, probably not to leave them to their competitors.

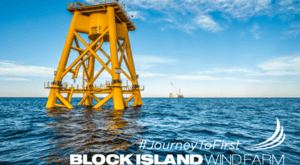

Meanwhile, GE was able to celebrate a milestone with their Haliade turbine. The first US wind farm was finally commissioned by Deepwater Wind (see picture on the left). The US offshore market had not been developed any earlier. Since the beginning of December, Block Island has now been producing electricity for nearly 17,000 households. Compared to their onshore success in the rest of the country, the farm is unlikely to play a big financial role for GE, but it creates an important momentum, because offshore wind will play a major role in the future of the United States.

Meanwhile, GE was able to celebrate a milestone with their Haliade turbine. The first US wind farm was finally commissioned by Deepwater Wind (see picture on the left). The US offshore market had not been developed any earlier. Since the beginning of December, Block Island has now been producing electricity for nearly 17,000 households. Compared to their onshore success in the rest of the country, the farm is unlikely to play a big financial role for GE, but it creates an important momentum, because offshore wind will play a major role in the future of the United States.

Senvion has also been able to hold their ground in the offshore business last year and will soon supply turbines for the German farm Borkum II. The company from Hamburg was also successful onshore and has been able to open up new markets. For example, two wind farms in Serbia will be equipped with Senvion turbines. Meanwhile, the acquisition of Kenersys has made the Indian market an even bigger target, where Senvion wants to compete with the locals of Suzlon. Jürgen Geissinger, CEO of Senvion, said: "We believe that this acquisition comes at the right time for us when the Indian Government sets its sights on 60 gigawatts of cumulative wind energy installations by 2022 and will have a positive impact on creating jobs in India for delivering state of the art solutions for India and additional markets."

Successful in India: Senvion (Image: Senvion)

A major target market for German manufacturer ENERCON continues to be the homeland where they have reached another milestone at the end of 2016: More than 20 gigawatts of installed capacity have not yet been achieved by any other manufacturer in Germany, even though their market share has shrunk somewhat in recent years. However, the Aurich-based company is now able to register more than 40 GWs worldwide.

It is thus not to be expected that output pressure among turbine manufacturers will decrease in the coming years, even if a total of more countries will rely on wind energy in the future.

- Author:

- Katrin Radtke

- Email:

- kr@windfair.net