News Release from windfair.net

Wind Industry Profile of

Summarising U.S. renewable energy export opportunities in selected markets

The renewable energy sector promises continued growth for the foreseeable future, reaching $7 trillion of expected cumulative global private-sector investment between 2012 and 2030. Despite some short-term challenges, growth is expected in each renewable energy subsector, including wind, solar, geothermal, biomass, hydropower, and renewable fuels – albeit at different rates.

To better position U.S. exporters of these technologies for success in international markets, the U.S. Government launched the ambitious Renewable Energy and Energy Efficiency Export Initiative (RE4I) in December 2010. This Renewable Energy Top Markets Report is an important commitment of the RE4I. Intended to provide high-level information regarding key potential export markets for American companies, it provides a tool to steer exporters towards those markets where they may be most effective.

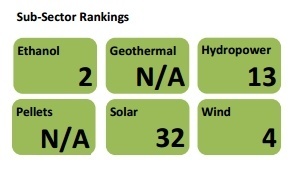

Please note that rankings in the study [see Figure 1] are based solely on projected exports from the United States through 2015. Company-specific priorities may vary.

From this day onwards Country Case Studies that summarize U.S. renewable energy export opportunities in selected markets will be in series. In several press releases country case studies will provide overviews describing U.S. renewable energy export potential in each market, as well as opportunities by subsector. Each case study will provide a high-level overview of the challenges exporters may face in the respective markets of Brazil, Canada, Chile, China, Italy, India, Japan, Mexico, South Africa, United Kingdom. Today we will be looking at Brazil.

Brazil - Type: Large Market; Large Market Share / Overall Rank: 3

Brazil is South America’s largest clean energy market. It generates nearly 80 percent of its electricity from renewable sources (including large hydro); and long term market growth remains all-but-certain. Yet, exports from the United States are unlikely to keep pace with the size of Brazil’s overall market due to substantial and intensifying trade barriers. Exporters are likely to find significant demand for their products and services, but often will need to partner with a local entity or utilize bank financing to make deals attractive to Brazilian buyers.

Brazil’s commitment to renewable energy is strong, driven by both its immense renewable energy resource potential and rising energy demand. New clean energy investment in Brazil totaled $5.34 billion in 2012 more than any other Latin American country. While no specific legislative targets exist, Brazil’s “TenYear Energy Plan,” published in 2011, envisions 18 GW of new renewable energy capacity being brought online by 2020.

Given Brazil’s existing manufacturing capacity, meeting this target will require the use of both imported and domestically produced technologies. However, many of the Brazilian Government’s incentives are geared towards supporting locally sourced products, making export projections difficult. Should policies including high import tariffs and local content requirements be removed, Brazil would likely be the most important export market for U.S. renewable energy products and services. Even with such policies, Brazil ranks third on ITA’s list of top export markets due in large part to several sectors projected to benefit from opportunities through 2015 and particularly the significant projected ethanol exports.

Paulo Afonso Hydroelectric Powerplant in the State of Bahia

Overview of the Renewable Energy Market

With growth occurring in almost every energy subsector, large hydropower still accounts for the vast majority of Brazil’s energy capacity. Large hydropower dams account for 84 GW of Brazil’s total energy capacity. Other renewable energy technologies account for 15.8 GW of capacity, including 9.84 GW for biomass and waste-to-energy; 3.69 GW for small hydropower; and 2.46 GW of wind power.3 Additionally, Brazil is a major global producer of ethanol, second only to the United States.

Since its successful 2002 “Program of Incentives for Alternative Energy Sources (PROINFA),” which resulted in 3.1 GW of new renewable energy generation, Brazil has used a broad range of policies to encourage the deployment of renewable energy. These include guaranteed 20-year power purchase agreements, biofuel blending mandates, low-interest financing, and tax-based incentives.

In 2009, PROINFA was replaced by a reverse auction system, through which developers seeking to build renewable energy projects compete against proposed conventional energy projects in regular tenders.

Windfarm in Osório, Rio Grande do Sul.

The reverse auctions have reduced the price paid by Brazilian consumers for renewable energy, as developers are incentivized to offer the lowest possible cost. The focus on price competition, however, has limited opportunities for solar or other higher priced technologies. Brazil has therefore held biomass- and wind-specific auctions to encourage the deployment of these technologies.

Following a November 2013 auction that was unsuccessful in getting solar developers to offer prices below the Government’s price point, a consortium of Brazilian energy companies called for solar-only auctions. Their proposal called for auctions that were similar to those afforded the wind and biomass industries and would be similar to the recent successful solar-only auction held in the State of Pernambuco, which resulted in 123 MW of new solar development.

Based on the initial negative reaction of the Brazilian Government’s Energy Research Company, however, it is unlikely that such auctions will occur in the near-term at the national level, likely limiting opportunities for utility-scale solar development.

Challenges and Barriers to Renewable Energy Exports

The need for developers to offer electricity at the lowest possible cost makes importing renewable energy technology from the United States commercially difficult. As a result, to date most U.S. exports have been in the form of services and high value-added products that are not available domestically. The situation is aggravated by significant import barriers. Brazil maintains a 14 percent import tariff on wind turbines, component parts for the wind industry, and hydropower turbines. It also charges a 12 percent tariff on imported solar equipment, both PV and thermal.

The most important challenge, however, pertains to financing. The lending practices of Brazil’s development bank, Banco Nacional de Desenvolvimento Econ?mico e Social (BNDES), pose a significant hurdle to U.S. exports. BNDES plays a major role in financing Brazil’s renewable energy growth and is among the largest lenders to the clean energy industry globally, disbursing nearly $29 billion for renewable energy projects between 2007 and 2011.

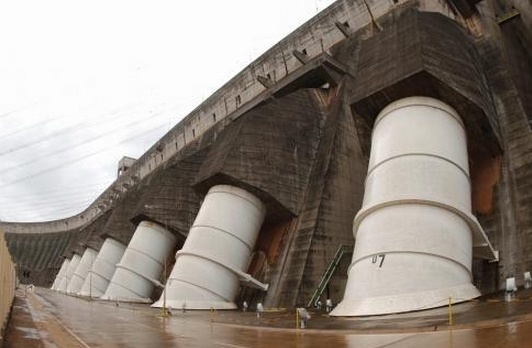

View of Itaipu hydroelectric power plant in the State of Paraná.

While there is no explicit local content requirement for participation in Brazil’s renewable energy power auctions, BNDES uses local content rules in determining which companies qualify for its low-cost credit. Since BNDES provides the most favorable financing terms, its financing creates a de facto local content requirement for the Brazilian market. To illustrate this point, out of the 81 operating wind farms in Brazil, the only one that has thus been developed without BNDES financing was financed by the Chinese Development Bank and used Chinese-manufactured turbines.

In December 2012, BNDES amended its local content requirements for wind projects, making those requirements far more stringent. These requirements include a roadmap for compliance, with each phase requiring a higher percentage of local content. By 2016, BNDES aims to complete an entire Brazilian wind manufacturing value chain in-country – severely limiting the potential for wind product exports from the United States.

Some export deals are nevertheless possible, particularly when facilitated by Ex-Im Bank financing. A recent $32.1 million Ex-Im deal that helped LM Wind export wind blades from its Arkansas-based facility to Brazil is a great example. Exporters will likely have to use similar methods to attract buyers, unless local content restrictions are removed or significantly weakened.

Opportunities for U.S. Companies in the Brazilian wind and solar energy

Wind

By the end of 2012, Brazil had over 7 GW of additional wind capacity in a pipeline of projects scheduled to be completed by 2016. While local content requirements and import tariffs limit the opportunity for exporting wind products, service exporters may find some opportunities working with developers of these projects. Wind resource mapping, wind turbine design, and assessing environmental impacts of wind farms should all provide opportunities for U.S. exporters.

Notably, Brazil does not currently manufacture small wind turbines, a market segment that enjoys considerable U.S. competitiveness. As Brazil gears up to host the World Cup in 2014 and the Olympics in 2016, promoting the use of small wind turbines may help create additional opportunities for U.S. exporters.

Solar

Little development has occurred to date in Brazil’s solar market, in which total installed capacity was just 7.5 MW at the end of 2012. However, 25 new solar projects totaling 967 MW applied to the Brazilian regulator, Agencia Nacional de Energia Eltrica (ANEEL), for permits in the first half of 2013 alone; and since 2011, Bloomberg New Energy Finance reports that over 3.9 GW of solar permits have been requested. As these projects move to completion, some export opportunities should become available, although total solar exports to Brazil will remain limited into the medium-term.

Ethanol

While Brazil is a major ethanol producer, it is also a significant market for American ethanol exporters. The reasons are twofold: Brazilian consumption of ethanol is extremely high; and consumers are price conscious because they can choose their blend at the pump. In particular, demand in Northeast Brazil for imported ethanol is strong and should remain a driver of ethanol exports into the future. Exports, however, are closely tied to weather, making future projections difficult. During periods of drought or a smaller-than-usual sugar cane harvest, Brazil imports substantially more ethanol from the United States – as was the case in 2011, when the United States exported $1.2 billion worth of ethanol to Brazil, up from just under $300 million in 2010.

Hydropower

Brazil offers opportunities for U.S. hydropower exporters. However, the legal disputes surrounding the Belo Monte hydropower plant currently under construction are likely to hinder the development of future large hydropower projects. Two market segments likely hold the most promise for U.S. exports through 2015: small and medium hydropower equipment; and hydropower services. Though Brazilian and Argentine suppliers dominate the large hydropower market, U.S. exporters enjoy considerable market share in the small and mediumsized hydropower market. Brazil’s hydropower reserves hit historically low levels in 2012. Ensuring that the country’s existing facilities are producing the most power possible, either through retrofits or system optimization, should provide American service exports with new opportunities.

In the next press release we will be looking at Canada

- Source:

- United States Department of Commerce – International Trade Administration

- Email:

- ts@windfair.net

- Link:

- w3.windfair.net/...