News Release from windfair.net

Wind Industry Profile of

Wind Turbine Manufacturers: Change at the Top

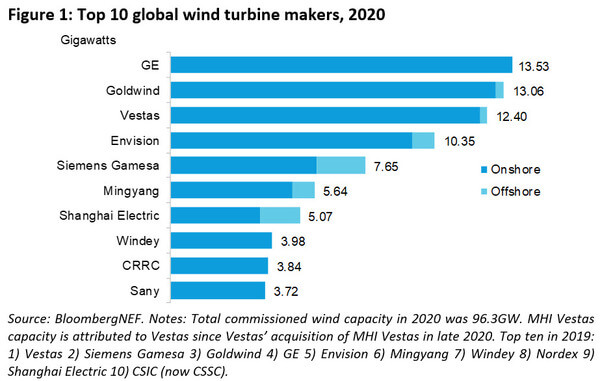

After initial difficulties, the wind market in 2020 was unimpressed by COVID-19 and had a record-breaking year. A very strong fourth quarter in particular ensured that almost 100 gigawatts of new installations were commissioned - an increase of 59% on the previous year. 93% of this was accounted for by onshore installations, as a BloombergNEF analysis shows. Offshore expansion, on the other hand, was weaker: Only 6.5 gigawatts of new wind turbines were installed, a drop of 13% compared to 2019.

Strikingly, only four manufacturers installed more than half (51%) of the turbines deployed. The gap between the leading manufacturers and smaller players has thus widened further.

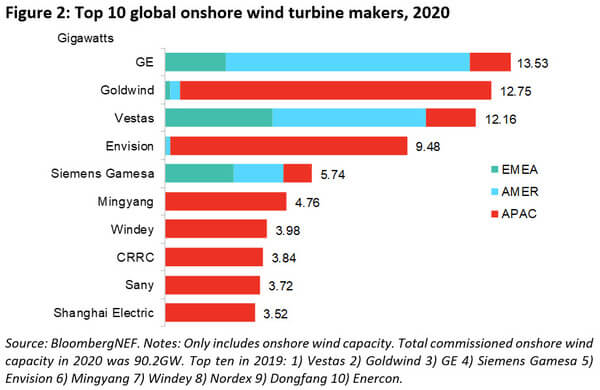

For the first time in four years, there's a new leader: U.S. manufacturer GE Renewable Energy benefited from a very strong domestic market and took the lead. It is followed by Goldwind, a Chinese manufacturer that was also successful primarily in its home country. Only in third place is the former leader Vestas.

Manufacturers 2020 total figures (Source: BloombergNEF)

“GE and Goldwind claimed the top two spots in this year’s ranking by concentrating on the largest markets. This strategy may not be as fruitful in 2021 as subsidies lapse in those areas,” said Isabelle Edwards, wind associate at BloombergNEF and lead author of the 2020 Global Wind Turbine Market Shares report. “Vestas takes on less market risk, with turbines commissioned in 34 countries last year.”

“While every region commissioned more wind capacity than the year prior, the unprecedented growth observed in 2020 should be credited to the Chinese wind market,” said Edwards. “Nearly every turbine maker is now selling turbines into China, and in 2020 it was the second-largest market for both GE and Vestas.”

Another reason for this huge influx in China, according to Leo Wang, wind expert at BNEF in Beijing, is that the expiry of onshore and offshore subsidies has fuelled the surge in installations. Following the expiry of onshore feed-in premiums, the market is likely to face a drop in demand in 2021. In the U.S., the strong growth is also due to a phase-out of the Production Tax Credit (PTC).

Manufacturers' onshore shares in 2020 (Source: BloombergNEF).

Meanwhile, there was no change at the top in the offshore segment. Siemens Gamesa could still install the most turbines in 2020 - and is already pointing to full order books until 2025. In an effort to reposition itself as the leading turbine supplier for the offshore wind industry, Vestas acquired MHI Vestas Offshore Wind at the end of 2020. But it could be a few years before this move permanently changes the market for turbine suppliers. In the meantime, Chinese manufacturers are also making good gains here, with five of them overtaking Vestas: Shanghai Electric, Mingyang, Envision, Goldwind and CSSC.

- Source:

- BloombergNEF

- Author:

- Windfair Editors

- Email:

- press@windfair.net

- Keywords:

- BloombergNEF, turbine, manufacturer, top, ranking, installation, GW, MW, USA, China, Vestas, GE, Goldwind, onshore, offshore