News Release from Vattenfall Europe Sales GmbH

Wind Industry Profile of

Opinion: The Case for Onshore Wind

What did you make of the Committee on Climate Change’s Net Zero report and the government’s decision to back it?

The Committee’s (CCC) report is the most important UK document on climate change this decade. I think this is recognised by the UK government, which this week, to its enormous credit, committed to the target. It is important to reflect on this achievement of the UK becoming the first major global economy to make that commitment, second only to the passing of the Climate Change Act in 2008. This transition will transform the UK economy and the investment that goes with it will boost the economy.

But the really hard work starts now, doesn’t it?

Public policy detail is fundamental to success. In the summer we expect an Energy White Paper and in 2020 the Committee will set out how the UK can get 2032 carbon budgets back on track. This will be really important. We hope and expect both to get behind onshore wind. Public support is there, a growing number of Tories see the sense in it and, of course, the climate emergency is upon us.

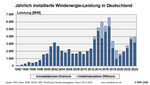

The CCC report talked about increasing onshore wind capacity from today’s 13GW up to 35GW by 2035, and independent analysis for RenewableUK says that this could reduce bills by up to 7%. What is the single most important policy change needed to support onshore wind?

The CCC report talked about increasing onshore wind capacity from today’s 13GW up to 35GW by 2035, and independent analysis for RenewableUK says that this could reduce bills by up to 7%. What is the single most important policy change needed to support onshore wind?

Guy Mortimer (image left): The UK government has never adequately explained why they have turned a great, simple, deal down. Give the sector a stable price pitched so that it has no additional impact on the consumer.

When onshore wind was denied entry into subsidy auctions the pace of new investments in the industry slowed to a crawl. The case for letting the sector back into auctions is strong. With a predictable revenue stream, we avoid volatility and can lower the cost of our capital. We can do this because onshore wind is so cheap – the cheapest form of new-build generation, in fact. In return, investment will increase. But the beauty of the mechanism is that if the wholesale market price exceeds the auction price, generators pay the difference back in to the pot. One estimate by BVG Associates is that this can be more than £1.6bn for 5GW of shovel-ready projects. That 5GW could also create 18,000 construction jobs at peak and 8,500 long-term maintenance jobs in rural economies. And the recent Vivid Economics report says a significant increase in capacity by 2035 (up to 35GW) will reduce average consumer bills, by as much as £50 a year.

There is every chance that if onshore is supported by auctions, it will actually return value to the consumer and, ironically, subsidise more expensive technologies.

Onshore wind is critical to net zero success, its record over the past 30 years shows what it is capable of. And, of course, if retired onshore wind capacity is not replaced, or repowered, then the pressure on other sectors ratchets up.

Can’t long term power purchase agreements get investments over the line?

There are PPAs available out there, but not in enough volume to support every consented wind farm’s route to market. Without support this will limit the potential of onshore wind and put greater pressure on other sectors to up their contribution towards net zero by 2050.

The report made a lot of a fair transition for workers. Can onshore wind match offshore wind’s economic potential?

Pound for pound, easily. We have seen a competitive UK supply chain support our six operational onshore wind projects. To us, supporting new projects means securing thousands of jobs. A civil engineer who might have worked on an open cast coal mine - perhaps by acquiring some new skills - could just as easily work on the construction of an onshore wind farm.

You have been at the helm of Vattenfall’s onshore wind development business since 2014. As you prepare to make your next move in Vattenfall, do you have any advice for your successor?

Don’t give up. The fundamentals of onshore wind – low cost, rapid deployment, securing skilled jobs, fossil fuel-free generation - will make it the wise choice for policy makers.

- Source:

- Vattenfall

- Author:

- Press Office

- Link:

- group.vattenfall.com/...

- Keywords:

- onshore, Vattenfall, interview, wind energy, UK, net zero carbon emissions, CO2, auction