News Release from Bloomberg New Energy Finance (BNEF)

Wind Industry Profile of

World-Wide Wind Investments Rose Again in 2018

Global clean energy investment totaled $332.1 billion in 2018, down 8% on 2017. Last year was the fifth in a row in which investment exceeded the $300 billion mark, according to authoritative figures from research company BloombergNEF (BNEF).

But there were contrasts between different types of renewables. While investments in wind energy rose 3% to $128.6 billion, solar investment dropped 24% to $130.8 billion. Part of this reduction was due to sharply declining capital costs.

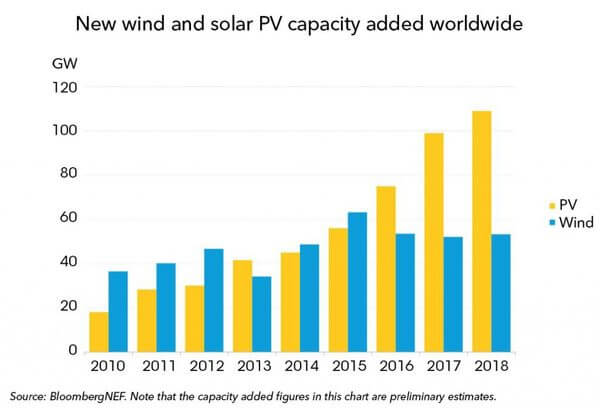

Jenny Chase, head of solar analysis at BNEF, commented: “2018 was certainly a difficult year for many solar manufacturers, and for developers in China. However, we estimate that global PV installations increased from 99GW in 2017 to approximately 109GW in 2018, as other countries took advantage of the technology’s fiercely improved competitiveness.”

Offshore wind on the other hand had another good year as 2018 came in as its second-highest year. The sector attracted $25.7 billion which is a plus of 14% on the previous year. Some of the projects financed were in Europe, led by the 950MW Moray Firth East array in the North Sea, at an estimated $3.3 billion, but there were also 13 Chinese offshore wind farms starting construction, for a total of some $11.4 billion.

David Hostert, head of wind analysis at BNEF, said: “The balance of activity in offshore is tilting. Countries such as the U.K. and Germany pioneered this industry and will remain important, but China is taking over as the biggest market and new locations such as Taiwan and the U.S. East Coast are seeing strong interest from developers.”

Investment in onshore wind was up 2% to $100.8 billion. The biggest projects were the green light for Enel Green Power's 706MW South Africa portfolio, at an estimated $1.4 billion, and the Xcel Rush Creek installation in the U.S., at $1 billion for 600MW.

Money committed to smart meter rollouts and electric vehicle company financings also increased.

China was once again the clear leader in investments, but its total of $100.1 billion was down 32% on 2017’s record figure because of the plunge in the value of solar commitments which came mid-year.

Jon Moore, chief executive of BNEF, commented: “Once again, the actions of China are playing a major role in the dynamics of the energy transition, helping to drive down solar costs, grow the offshore wind and EV markets and lift venture capital and private equity investment.”

In on second place came the U.S. at $64.2 billion, up 12%. Developers have been rushing to finance wind and solar projects in order to take advantage of tax credit incentives, before these expire early next decade.

The investments of Europe went up 27% to $74.5 billion, helped by the financing of five offshore wind projects in the billion-dollar-plus category.

- Source:

- BloombergNEF

- Author:

- Windfair Staff

- Email:

- press@windfair.net

- Keywords:

- BNEF, investment, renewable energy, wind energy, solar, gloabl, decline, rise, onshore, offshore, China, USA, Europe